Approaches to Retirement

A report from the Social Security Administration had a somber update regarding the future of Social Security funds: The current costs of the program are expected to exceed revenue by 2035, meaning the funding will be “insufficient” to cover all 64 million people who accepted Social Security benefits in 2019, a majority of who are retired.

Thinking about retirement is stressful, but a future where someone sees their benefits disappear could be even worse. Therefore, thinking about retirement as soon as possible is critical to maintaining financial health for years to come. Employer-sponsored retirement planning – such as 401(k) plans – have lessened the burden for some, but many manage their retirement on their own.

We polled 1,000 people currently saving for retirement to learn where the average person stands regarding their retirement goals and how they feel about the future. Learn more about how people are approaching retirement by exploring our findings below.

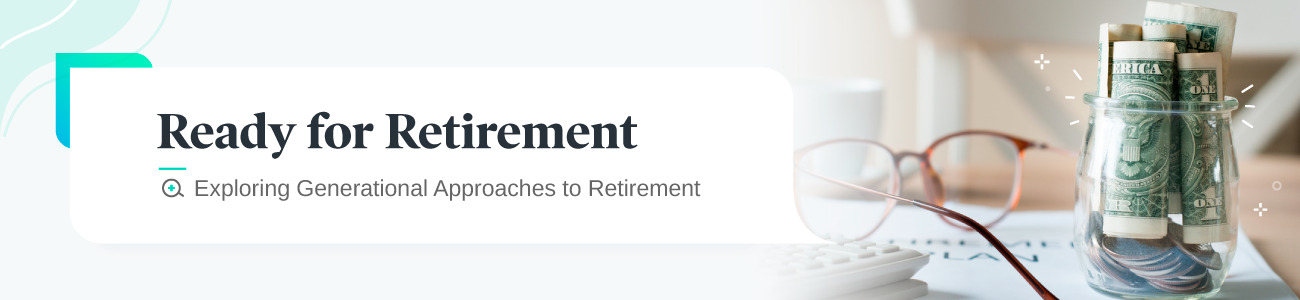

Retirement 101: 4 in 5 Americans Are Saving

These days, uncertainty about the future has led many people to regret not committing to saving for retirement sooner: Nearly 56% of those surveyed believed they started retirement planning too late.

Recent research from the Stanford Center on Longevity suggests that waiting to access Social Security benefits at age 70 can help secure long-term financial security with a fixed income. This may help push the 20% of people surveyed who aren’t currently devoting funds to retirement to start planning.

Falling behind on retirement savings can be stressful, especially for younger people who may have less financial experience. A 2018 report from the National Institute on Retirement Security revealed that an estimated 2 in 3 people ages 21 to 32 had no retirement savings. Of those in their 20s who had begun saving, the average age was 22.6, nearly 13 years sooner than people ages 50 and older.

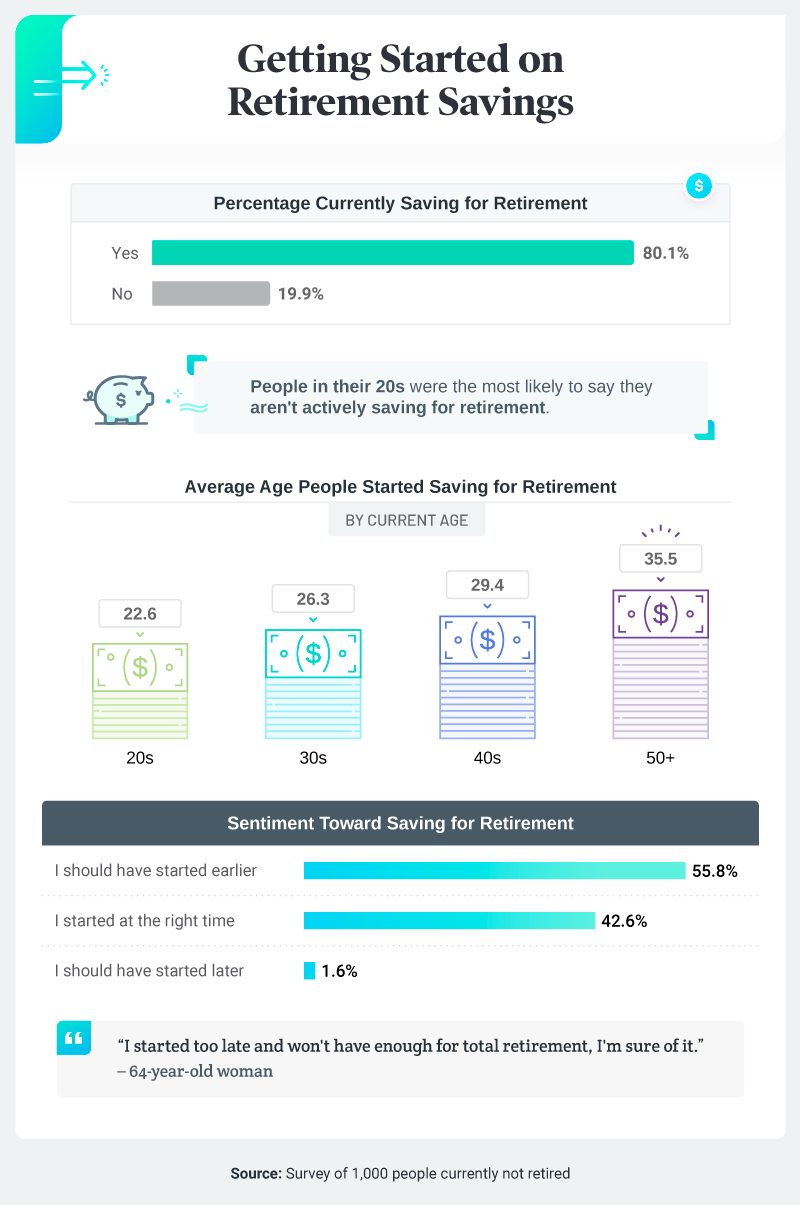

401(k), Roth IRA Top Saving Methods

When it came to how survey participants saved for retirement, they commonly benefited from tax-advantaged accounts, meaning they offer tax benefits. These often take the form of a 401(k), individual retirement account (IRA), or a Roth IRA. Among people currently saving for retirement, nearly 55% reporting having a 401(k).

The 401(k) came to be in 1978, originating from section 401, subsection “k,” of the U.S. tax code set forth by the IRS. This new text established the foundation for employer-sponsored retirement plans, outlining the ways that employers could offer retirement packages for their employees. We found that nearly 9 in 10 people with employer-sponsored retirement accounts had their contributions matched by their employer.

In fact, the majority of people actively saving for retirement had access to an employer-sponsored retirement account: 77% of respondents currently had a retirement account through their employer. Job security also means benefits security. However, 401(k) contributions can fall short due to an immature system and fees associated with the early removal of funds.

Savings Goals vs. Reality

At first, $500,000 for retirement sounds like a solid nest egg. That is the median amount that survey participants believed would be sufficient for their retirement. However, assuming that a person will live 25 years after retirement (which isn’t all that unlikely these days with advancements in medical care), $500,000 only gets you an annual retirement salary of $20,000, which is not a lot to survive on.

In reality, respondents were far off from that $500,000 goal. For example, people ages 50 and older reported a median savings of just $130,000. This shows how important it is to think about financial security early, rather than worrying about it later in life. One goal should be maxing out retirement contributions, which vary from plan to plan. For instance, as of November of 2019, the maximum contribution to a 401(k) plan was $19,500 per year, allowing employees more room to grow their retirement earnings.

For those who manage to hit their contribution limits, though, there are other ways to put money toward your future. Low- to moderate-income earners can take advantage of up to $1,000 in tax credits through the Retirement Savings Contributions Credit, or “Saver’s Credit.”

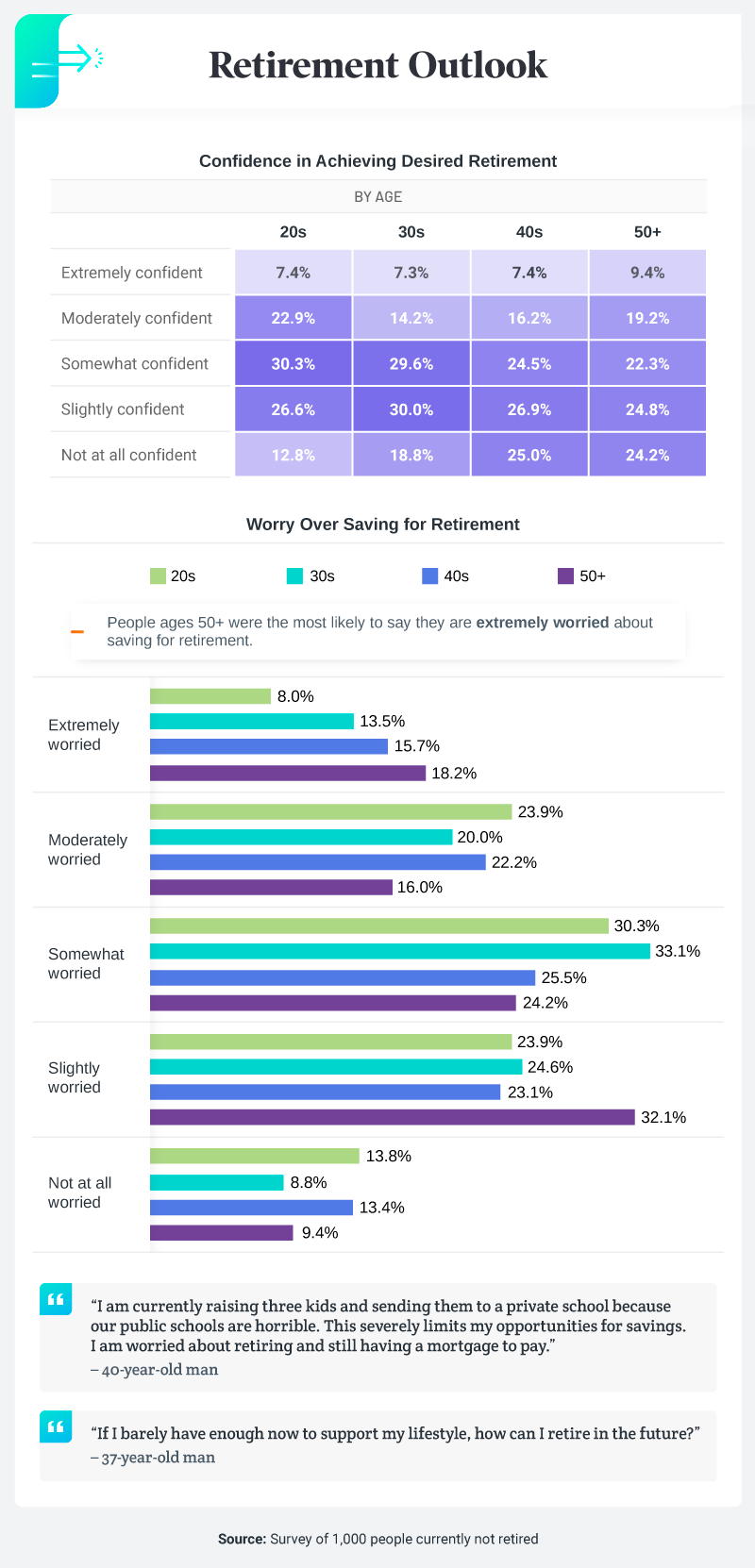

Retirement Confidence Up Among Younger Respondents

Younger generations have the luxury of time on their side, compared to someone who is 50 years old and quickly approaching retirement age. We observed an inverse correlation between age and optimism toward retirement security: 18% of survey participants ages 50 and older admitted to being extremely worried about retirement, compared to only 8% of people in their 20s. On the other hand, 20-somethings were the most likely to feel moderately confident in their ideal retirement prospects.

However, most people surveyed were “somewhat worried” about their retirement. It’s natural to be stressed about putting money aside for the future when it’s hard enough to pay current bills. Everyone, especially older Americans, can benefit from a range of retirement saving methods. For example, a large bonus can be partially invested in your IRA to gain maximum savings. Another option is staying close to your current means and only committing to 1% increases to your 401(k) contributions.

The key is understanding your own financial situation and framing your plans around that.

Thinking About Retirement? Start Planning Today

The language around retirement savings can prove confusing. From navigating an increasingly convoluted U.S. tax code to countless acronyms, the entire process can be difficult to handle. For people currently saving for retirement, optimism can be rare, but staying informed will help answer any questions and build your confidence in future financial security.

Being prepared for the future, both fiscally and mentally, can help you retain independence well into retirement. And the peace of mind that medical alarms provide can help relieve at least one pain point related to aging. Turn to the MedicalAlertBuyersGuide.org for top expert advice on the medical alarm systems that will work best for you or a loved one.

Methodology

We surveyed 1,000 people who are not currently retired about how they’re preparing for retirement, as well as how they feel about it. Respondents were 54.1% women and 45.9% men. The average age of respondents was 41.9 with a standard deviation of 13.2.

People were asked to report what tax-advantaged retirement accounts they currently had. This was a check-all-that-apply question, so percentages might not equal 100.

When reporting the total number of retirement accounts they had, respondents were instructed to include all types of accounts, including personal savings accounts, as long as the sole purpose of the account was saving for retirement. The average number of accounts was calculated to exclude outliers. This was done by finding the initial average and multiplying it by three. That number was then added to the initial average. Any data point above that sum was excluded.

The same process was performed to exclude outliers for the average number of times people contributed to their retirement per year. Additionally, when asked how often they contributed, respondents were instructed to answer based on the account they contributed to most frequently if they had multiple accounts.

Limitations

The data presented in this project rely on self-reporting. Common issues with self-reported data include selective memory and exaggeration. It’s possible that respondents could have exaggerated the number of times they contribute to their retirement accounts and/or the total amount they currently have saved, skewing the data.

Fair Use Statement

Preparing for retirement can be daunting no matter your age. If you know someone who would benefit from the findings in this project, you are free to share this for any noncommercial reuse. Please be sure to link back here so that people can view the entire study and review the methodology. This also gives credit to our hardworking contributors.